Direct Indexing with Smartleaf

With Smartleaf, direct indexes are as easy to work with as ETFs. Both are simply options on a pull-down menu. There's no extra account set up, no creating of separately managed accounts, no sub-accounts and no waiting. Smartleaf portfolios are analyzed daily, not on an ad hoc or biweekly basis.

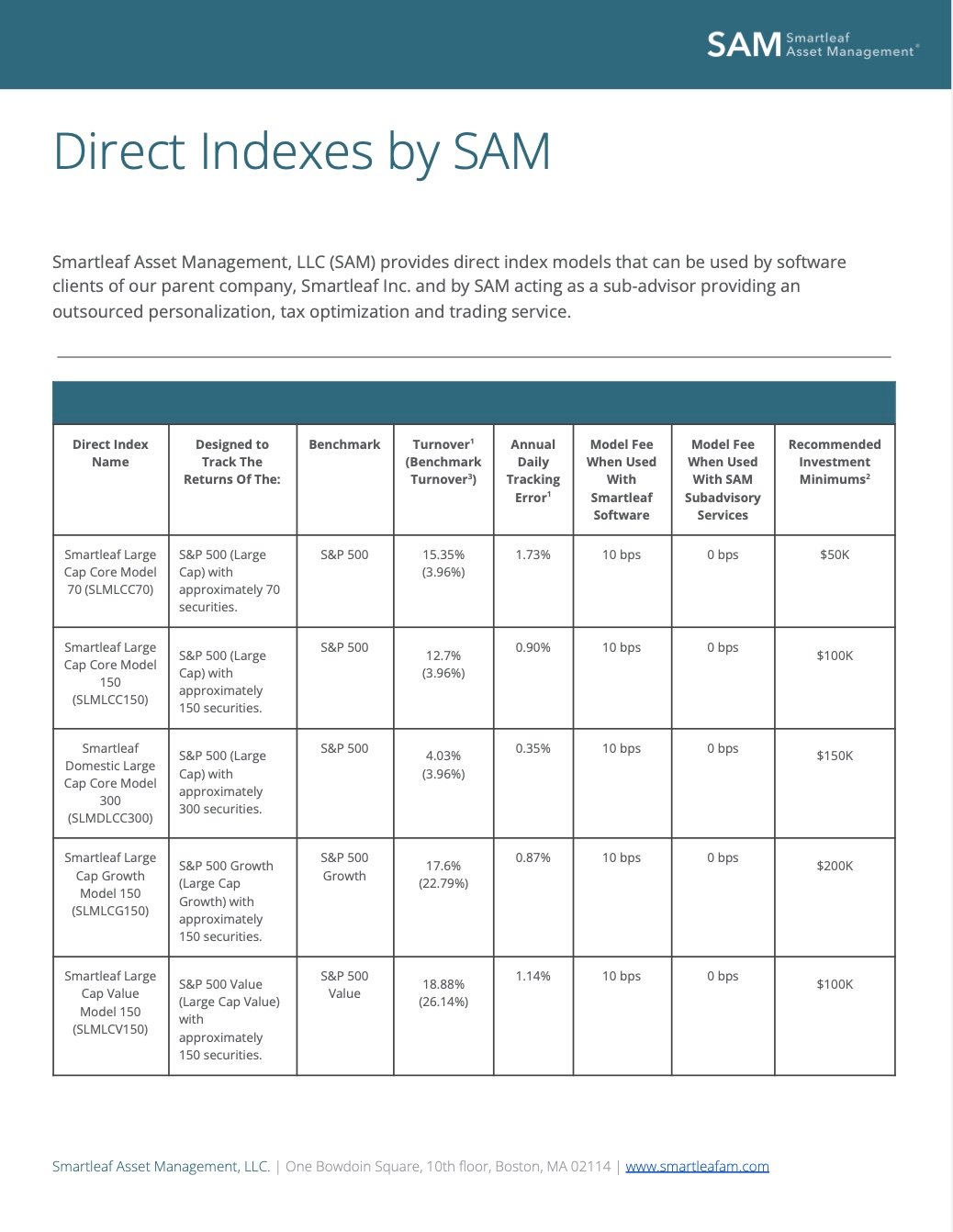

Smartleaf offers an open-architecture model marketplace, enabling clients to select from a wide array of direct index models (including those provided by our RIA subsidiary, Smartleaf Asset Management).

Find more information about SAM's Direct Index Models on the SAM website.

Smartleaf Blogs on Direct Indexing

Direct Indexing FAQ

A Q&A on direct indexing

Start Reading

The Direct Index Domino Effect

Replacing ETFs and mutual funds is only the beginning of how direct indexes will change wealth management.

Start Reading

Direct Indexes Are Better Than ETFs

ETFs and index funds outperform most actively managed investments. That's impressive, but there's an instrument out there ...

Start Reading