Direct Indexing

Direct indexes are baskets of equities (e.g. IBM, Ford) that 1) track the performance of an index (e.g., S&P 500) and 2) are directly (hence the name) owned by investors. Direct indexes stand in contrast to mutual funds and ETFs, which also track an index, but don’t provide investors with direct ownership of the underlying securities — instead, the investor owns shares in the fund, which, in turn, directly owns underlying shares.

There are three main advantages to direct indexes relative to a comparable ETF or index mutual fund: tax efficiency, risk customization and social-values customization. Let’s take each of these in turn:

- Tax efficiency: ETFs are tax-efficient. Direct indexes are more tax-efficient. They’re better at tax loss harvesting, better at gains deferral and better (sometimes much better) at transitioning from legacy portfolios. The greater tax-efficiency of direct indexes means that a direct index should outperform a comparable ETF on an after-tax expected basis. That’s a big statement. Pre-tax, index ETFs already outperform something like 80% - 90% of all investments.

- Risk customization: “Risk customization” means modifying a portfolio to compensate for outside risk exposures. For example, if you work for Exxon, you already have financial exposure to the fortunes of the energy sector and you might therefore choose to underweight energy in your portfolio. You can’t do that with a broad-index ETF — you can’t ask for the managers of SPY (an S&P 500 ETF) to leave out the energy sector just for your portfolio – but you can do precisely that with a direct index.

- Social values customization: The same story applies to social values (ESG and religious values) constraints. You can’t ask for the managers of SPY to leave out tobacco stocks and firms that violate Catholic Values criteria. Nor can you ask SPY managers to overweight “green” stocks. You can with a direct index.

Direct indexes are more tax efficient than ETFs because they are better at tax loss harvesting, gains deferral and (in the case where you have legacy holdings of appreciated individual securities) tax-sensitive transition. More specifically:

- Tax loss harvesting: If you purchase an ETF and its underlying index goes up in value, you can’t do any loss harvesting. But even though the index went up, it’s likely that some of the individual shares went down. With a direct index, you can sell those individual losers.

- Gains deferral: If you sell an ETF, you’re effectively selling every share of the underlying index pro rata. With a direct index, you can selectively avoid selling the top gainers.

- Transition: Imagine you want to transition a legacy equity portfolio into an index. If you invest in an ETF, you’ll have to start by liquidating your existing holdings. With a direct index, you can incorporate some of your current holdings into your direct index portfolio. The only trades you need to make are those required to reduce concentrations and fill in missing sectors.

The correct answer is “it depends”, but we think a reasonable estimate is that direct indexes add around 1% per year in higher after-tax returns. This is only an estimate, and your results may be very different, depending on:

- your tax rates (the higher your tax bracket, they larger your tax savings).

- whether you can use realized losses to offset gains from elsewhere in your portfolio.

- your legacy holdings (direct indexes are especially valuable if you are transitioning from a legacy portfolio of appreciated individual securities).

- your asset class mix (the more volatile the asset class, the more opportunity for loss harvesting and gains deferral).

- market movements (less tax savings in flat markets, more in down markets from tax loss harvesting, more in up markets from gains deferral)

To illustrate what’s possible, we did a five-year backtest of a sector-rotation strategy implemented with ETFs vs direct indexes. The results: the direct indexes added 1.93% per year in tax alpha:

|

Tax Efficiency of Direct Indexes vs ETFs Five Year Tax-Managed Sector Rotation Strategy |

||

|

|

Annualized % |

Cumulative % |

|

Difference in pre-tax returns (direct index returns minus ETF returns) |

0.06% |

0.28% |

|

Difference in after-tax returns (direct index returns minus ETF returns) |

1.98% |

10.28% |

|

Direct index tax alpha |

1.93% |

10.01% |

We also did a simulation of the loss harvesting potential of direct indexes compared to ETFs and found that direct indexes supported 3 to 5 times the loss harvesting. See here for details.

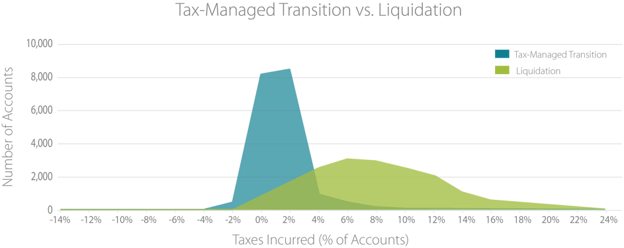

To gauge the value of direct indexes when transitioning from a legacy portfolio of individual equities, we compared the tax impact of transitioning to an ETF vs transitioning to a direct index for 18,000 actual investor equity portfolios. The difference? Converting to the ETF, which would require simply liquidating (selling all) existing holdings, would cost investors an average of 7.21% of portfolio value in taxes. Transitioning to a direct index in a tax-sensitive manner (as implemented using our tax-management transition analytics) would cost an average of only 0.29% of portfolio value. Here’s the graph:

They can, but direct indexes are usually managed in a way that will cause their returns to depart from those of the underlying index. Sources of return deviation include:

- Reduced holdings: For convenience or because of small portfolio size, most direct index investors prefer to own baskets with fewer names than are in the index (e.g. 70 or 150 stocks that track the S&P 500).

- Customization: Direct index investors have the option to customize their holdings. They can, for example, apply social screens (e.g. “never own tobacco”), or they can work around outside risk exposures (e.g. “don’t own IBM since I already have IBM stock options”).

- Tax management: Direct indexes can be tax managed at the tax-lot and security-level. This extra tax management means that direct indexes can outperform comparable index funds and ETFs on an after-tax expected basis. But it also means some deviation in pre-tax returns.

- Quantitative factor tilts: So-called “smart beta” direct indexing introduces explicit factor tilts (e.g. “momentum”, “value”). These factor tilts can be used simply to create style-variants of the original index. However, if you periodically update your tilts, you’re basically implementing an active strategy.

Most direct indexes really do aim to track, not outperform, their underlying index. And none are traditional “pick winning stocks one-at-a time” actively managed portfolios. On the other hand, they are usually significantly worse than comparable index funds in terms of their tracking error (drift) to the index.

So, there’s good reason to call them indexes and also good reasons to quibble. But, at the end of the day, the name doesn’t really matter. They’re customized, tax-optimized portfolios of individual securities constructed with an index benchmark as a starting point.

It’s a combination of an increase in both supply and demand. On the demand side, we see greater interest by advisors and investors in tax management, risk customization and ESG investing – areas where direct indexing shines. On the supply side, there have been multiple technological advances that make direct indexes more affordable and accessible.

There’s a back-to-the-future quality to direct indexes. Owning baskets of stocks long predates the invention of the mutual fund or the ETF. Direct indexes themselves have existed for decades. What’s new is that while direct indexes used to make sense only for ultra wealthy investors, they're now affordable and practical for ordinary investors; they can now be offered at a price point that makes them a superior alternative to ETFs for most investors. The technological innovations that have made this possible include:

- Lower transaction costs: Most major custodians are offering commission-free trades. This makes a difference. Even a low commission of, say $4.95, means buying a 100 stock direct index would cost investors almost $500. Zero-dollar commissions remove this barrier. Bid/ask spreads are also lower. Large players, like mutual fund companies, used to have a large advantage over individual investors in executing trades at low cost. Now, this is sometimes reversed; individual investors, who don’t need to worry about moving the market, may get better execution than mutual fund companies.

- Rebalancing automation: The tax and customization advantages of direct indexes are impressive, but they’re not automatic. You’ve got to actively manage a direct index portfolio to get tax savings and implement constraints – and do so in a way that keeps the portfolio close to its index benchmark. Traditionally, this was done somewhat manually by a highly compensated portfolio manager. But with sophisticated rebalancing systems, these tasks can now be automated.

- Fractional shares: For portfolios smaller than $50,000, the need to buy whole shares can distort direct index portfolios, resulting in excess tracking error to the index benchmark. Multiple brokers offer fractional-share trading, making it technically feasible to manage and rebalance direct index portfolios for investors with as little as $50.

Yes and no. Direct indexes can be used as a substitute for mutual funds, ETFs and SMAs. And, in a well designed program, doing so is trivial. In this sense, they’re just a product.

But, in a deeper sense, they’re not. Direct indexes don’t promise market-beating returns. That’s not their function. So direct indexes become less a product and more of a component of a deep transformation in wealth management: a trend away from product-, performance- and trade-oriented value propositions towards a value proposition based on acting as the client’s “lifetime financial coach”.

It depends. In a well-implemented program, managing direct indexes should be no more complicated than managing an ETF. Direct indexes have more moving parts than an ETF, but almost everything that might make working with a direct indexing challenging can be automated.

However, some common approaches to implementing direct indexes make managing them more difficult than necessary.

Historically, direct indexes have been premium products, costing far more than similar ETFs (negating much of the direct index’s tax advantage). But technological advances have made it possible to deliver direct indexes at radically lower prices. The management of direct indexes, even with tax optimization and high levels of customization, can be largely automated. At scale, direct indexes should be less expensive than both index funds and ETFs, which are structured as investment companies that are required to register with the SEC, have governing boards, and file annual reports. Direct indexes have none of this overhead.

Done right, direct indexes can be as easy to work with as ETFs. However, some common approaches to implementing direct indexes are inefficient.

Having investor-facing advisors manage direct indexes does not work at scale. Managing taxes and customization — while controlling drift and risk — is complex, and most advisors don’t do it efficiently or well, even with automation tools (worse, it’s a bad use of their time).

A better – but still suboptimal – approach to implementing direct indexes is to use separately managed accounts (SMAs), meaning you hand just the direct index portion of the account to an internal or external specialist manager. Though common, this approach has two shortcomings:

(1) SMAs are not optimal for tax and risk. If you embrace direct indexing, you’re buying into the advantages of customization and tax management (as well as the need to control their risk impact). However, taxes and risk are features of portfolios as a whole, not just the direct index portion. Standalone direct index SMAs do a pretty good job of tax-managing themselves, but you can do better if you manage tax and risk holistically at the portfolio level.

(2) Working with SMAs is time consuming and therefore expensive. With direct index SMAs, otherwise ordinary tasks — like account opening, account closing, investing new cash, implementing cash out requests, wash sale avoidance across the entire portfolio, and asset class rebalancing — require a separate workflow. For example, every time there’s a client cash out request, you have to figure out how much comes from the direct index manager and how much comes from the rest of the portfolio. All this complicates your workflow and takes time. For many advisors, it’s not worth the cost and hassle.

The way to avoid these shortcomings is to move from direct index SMAs to unified managed accounts (UMAs) with direct index cores. The idea is similar, but you let whoever is managing the direct index manage the entire portfolio. This keeps ordinary tasks simple — you just let the (internal or external) UMA manager take care of it. In this way, managing direct indexes literally becomes as easy as managing ETFs. Embracing direct indexes needn’t make your operations more complex — it can even make your operations simpler.

You might object that delegating management of the whole portfolio – either to an outside firm or to a central rebalancing group within your firm – means a loss of control over asset allocation and product choice. However, you can outsource rebalancing, tax management, customization, implementation and trading while retaining full control over strategy. Assuming the UMA manager has the tools to quickly implement strategy changes across a customized book of business, outsourcing will, counterintuitively, increase rather than decrease your control.

And once portfolio rebalancing is delegated, there are no longer barriers to investor-facing advisors offering customization and tax management to every investor. This means:

- Every account can have ESG or religious screens.

- Every account can have risk customization (e.g. if you work for Exxon, eliminate energy stocks from the portfolio).

- Every account can have tax-smart transitioning, year-round loss harvesting and risk-compensating gains deferral.

Delegating the day-to-day management of the portfolio – whether to an internal or external group – does come with one cost. It’s incompatible with old-style value propositions based on trade-by-trade conversations with clients, but for most firms, this is a plus. It replaces the unreliable quest for market-beating performance with solid, customized, low-cost, tax efficient investing, which becomes a backdrop for the advisor's main role — acting as the investor’s financial coach and guide.

“Gains deferral” means not selling something that, but for tax considerations, you would have sold. There are two types:

(1) Short Term Gains Deferral: You delay selling a short-term position until it’s long term. Roughly speaking, this cuts your tax bill in half

(2) Long Term Gains Deferral: You delay selling a long-term position, maybe for just a while, maybe permanently. If you do eventually sell, you’re still getting value, in the form of a delayed (deferred) tax bill. It’s the equivalent of an interest-free loan. And if you never sell, either because you hold the position until death, or you donate the position to charity, you avoid capital gains taxes entirely.

Gains deferral sounds simple. After all, how hard is it to not sell something? But there’s more going on than just refraining from a sale. The challenge of gains deferral is to avoid selling appreciated positions while still ending up with the portfolio you want. The downside of holding onto a position for tax reasons is that you’re left owning more of the position than you want. And that means you're exposed to a particular stock’s performance more than you want to be. The key to gains deferral is keeping this risk under control. How?

First, actively “counterbalance” overweighted positions by underweighting securities that are most correlated with the security that is overweighted. If you’re overweighted in Exxon, underweight Chevron. The idea is to keep core “characteristics” (e.g. beta, capitalization, P/E, sector, industry, momentum, etc.) of the portfolio unchanged.

Second, don’t overdo it in the first place. If an appreciated security constitutes the majority of a portfolio, a deferral of all gains would be a case of the proverbial tax tail wagging the investment dog. How much concentration is too much? It depends on 1) how volatile the security is, 2) your return expectations for the security, relative to alternatives, and 3) how well you can effectively undo the overweight risk through counterbalancing. Done right, gains deferral requires optimized risk management, constantly balancing tax and risk considerations.

Direct indexes are better than index ETFs and mutual funds at gains deferral because direct indexes allow you to be more selective about what gains you defer. There are three use cases: cash withdrawals, asset-class rebalancing, and transition.

- Cash withdrawals: If you sell an ETF, you’re effectively selling every share of the benchmark index pro rata. With a direct index, you can selectively avoid selling the top gainers. Suppose, for example, you own appreciated shares of an ETF that tracks a 100 stock index, and you want to raise cash: you’ll need to sell some of your ETFs and realize gains. But even if, on average, the 100 stocks went up, some went up less — and it’s likely that some even went down. If you own all 100 stocks directly, you can choose to sell just those with a loss or minimal gains. You may be able to withdraw cash and pay little or no taxes (you will want to do this carefully — you don’t want to minimize taxes and end up with an excessively risky portfolio that strays from the index you were trying to track. Sophisticated managers use risk models to manage the trade offs between low taxes and fidelity to the index).

- Asset-class rebalancing: This same “preferentially avoid selling the top winners” advantage of direct indexing can also be used when you’re rebalancing portfolios at the asset-class level. Suppose you have a portfolio with just two asset classes, large cap and mid cap, and you want to maintain an asset allocation of 50/50. Suppose further that the large cap goes up and so you want to rebalance back to 50/50. If you owned just two ETFs — one large cap and one mid cap — you’d have to sell the large cap ETF, realize gains, and buy the mid cap. If each ETF was tracking a 100 stock index, you’d effectively be selling the 100 stocks in the large cap index and buying the 100 stocks in the mid cap index. In contrast, with direct indexing, you could choose to sell just a few large caps stocks — those with little or no gain — and buy just a few mid cap stocks. You can also consider that little is to be gained by selling the smallest large cap stocks and buying the largest mid cap stocks. Instead, you can preferentially sell the larger large caps and buy the smaller mid caps. In this way, you can transition to your desired asset allocation with both less turnover and lower taxes than if you owned ETFs.

- Transition: Imagine you want to transition a legacy equity portfolio into an index portfolio. If you invest in an ETF, you’ll have to start by liquidating your existing holdings. With a direct index, you can incorporate some of your current holdings into your direct index portfolio. The only trades you need to make are those required to reduce concentrations and fill in missing sectors. The difference in tax efficiency can be striking. We conducted a study that compared the tax impact of liquidation vs tax sensitive transition for the large-cap individual equity holdings of 18,000 actual investor portfolios. The difference? Selling off all the equities and buying an ETF would cost investors an average of 7.21% of portfolio value in taxes. Transitioning to a direct index in a tax-sensitive manner would cost an average of only 0.29% of portfolio value (though with larger tracking error to the index). Here’s the graph:

A little more on the study methodology: Smartleaf looked at the large cap equity holdings of 18,000 mostly high net worth accounts that were being professionally managed by Smartleaf clients — bank trusts, broker dealers and RIAs — with Smartleaf software. The comparison was of two trading strategies: 1) selling all the equities and buying an ETF, and 2) transitioning the equity holdings of each account to a direct index. For the purposes of the study, every investor was assumed to have tax rates of 20% on long term gains and 40% on short term gains, and trading costs were ignored (paying attention to trading costs would make direct indexing look even better, since the direct index approach requires less trading). The strategy of selling everything and buying an ETF was assumed to result in zero tracking error to the index (that is, it was assumed the ETF tracked the underlying index exactly). In contrast, the accounts that were transitioned to a direct index in a tax sensitive manner had an average tracking error (roughly speaking, average return drift) of 1.54%. This illustrates the trade off between tax management and fidelity to the index. A key part of tax management is controlling this trade off.