The biggest change happening in wealth management is in functional roles

Our blog post, Old vs. New Wealth Management, is our highest read blog. Ever.

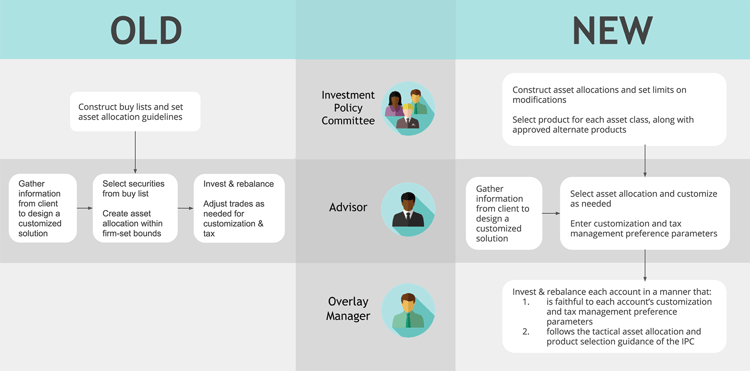

Clearly, there’s interest in the topic. We wanted to take a look at the topic from a different perspective: how roles in wealth management will change. At the heart of these changes is a new division of responsibility and a higher level of specialization. In particular, disparate functions that used to fall on the advisor are now divided among three specialist groups: the advisor, the investment policy committee, and (a new role) the overlay manager. We’ll look at each of these roles in turn.

The Investment Policy Committee (IPC)

The old:

The IPC constructs buy lists of approved securities and sets asset allocation guidelines.

The new:

The IPC constructs asset allocations and suggests product (e.g. mutual funds, ETS, weighted lists of securities) for each asset class. As importantly, the IPC sets compliant limits on the construction of custom asset allocations and alternate product choices. The IPC may also set limits on asset class and/or security drift. And the IPC will set firm rebalancing policy.

The Advisor

The old:

The advisor trades portfolios, selecting securities from the firm’s buy list, making sure portfolios fall within the firm’s asset allocation guidelines. Advisors fold customization and tax management considerations into their choice of trades for each account.

The new:

The advisor constructs custom solutions for each account. The advisor selects, for each account, the IPC created asset allocation most suited to an investor’s needs. The advisor modifies this asset allocation and/or product mix and sets transition, tax management, ESG and other parameters, as appropriate to meet the investor’s individual needs.

The Overlay Manager

The old:

N/A. The overlay manager is not a role that existed in traditional wealth management.

The new:

The overlay manager trades each account in a manner faithful to the joint instructions of the IPC and the customization parameters set by the advisor.

The graphic at the beginning of this post summarizes these changes in roles. Implementing this new wealth management is non-trivial, but the payoff is large:

- It’s much more efficient.

- It reduces the incremental cost of customization and tax management to zero, so it becomes economical to provide high levels of customization and tax management to all clients.

- Advisors get to spend more time with their clients.

- It’s more consistent. Similar accounts will have similar outcomes. And policy changes of the IPC will usually be implemented across the entire book of business in one business day.

- It’s more compliant. By capturing client customization criteria and automating much of implementation, compliance becomes a “built in” feature of the process — not just an after-the-fact review.

As we concluded in our last post, the new wealth management is better than the old. It’s better for clients, who benefit from greater customization, superior tax management and more time with their advisors. And it’s better for most advisors, who can spend more time guiding clients to meet their financial needs.

COMMENTS